Our President’s Comments

Internal Markets Commentary 24th August 2020

August 27th, 2020|0 Comments

SPX Daily chart The S&P 500 extended its new all-time highs as it closed at 3443.6 with a gain of 0.36%. The total intraday range was 18.4 points. Any stock or index that hits [...]

Internal Markets Commentary

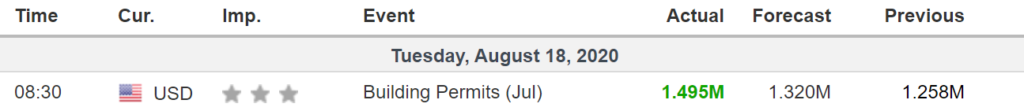

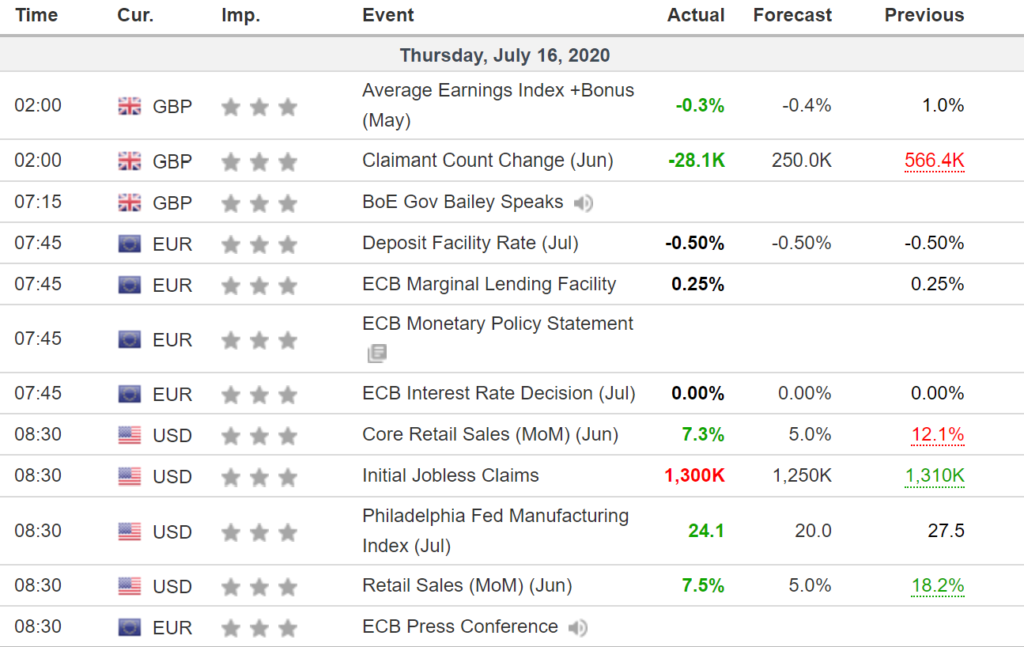

- U.S. Housing Starts jumped 22.6% in July to a seasonally adjusted 1.496 million units compared to the consensus estimate of 1.241 million units. June’s data was revised to 1.22 million units from 1.186 million units reported earlier. Building Permits came in at 1.495 million units in July compared to the consensus estimate of 1.333 million units. In this case as well, June’s data was revised to 1.258 million units from 1.241 million units reported earlier.

- Stocks are drifting on Wall Street Tuesday, and the S&P 500 is once again bouncing against its record closing level, which has been acting as its ceiling in recent days. The S&P 500 was virtually flat at 3,382.24 in midday trading. Earlier, it briefly rose above its record closing high of 3,386.15, which was set in February before the pandemic pancaked the economy. It’s the fourth time in the last week that’s happened, and each past time, the index faded back below that record level during the afternoon.

- This is the first day, though, that the S&P 500 crested above 3,393.52, which had stood since Feb. 19 as the highest level it ever touched within a day’s trading. The Dow Jones Industrial Average was down 87 points, or 0.3%, at 27,757, as of 11:12 a.m. Eastern time, and the Nasdaq composite was up 0.4%. Trading has been very quiet in recent days, after a tremendous rally since March wiped out virtually all of the nearly 34% drop the S&P 500 suffered earlier from its all-time high. Tremendous amounts of aid from the Federal Reserve and Congress helped launch the rally, which built higher on signs of budding growth in the economy. More recently, corporate profit reports that weren’t as bad as expected have helped boost stock prices.

- Now, analysts say markets are taking a pause with less news flowing in amid a seasonally slow period of trading. Big U.S. companies are mostly finished reporting their earnings for the spring, while investors are waiting to see if Congress and the White House can get past their partisan differences and agree on more aid for the economy.

- It’s mostly just retailers left in the S&P 500 to report their second-quarter results, and several continued the strong recent trend of delivering better results than expected.

- Advance Auto Parts rose 1.2% after it reported a much bigger jump in earnings for the spring than analysts had forecast. It said enhanced unemployment benefits and other aid for the economy provided earlier by the U.S. government helped its customers afford parts to repair and service their automobiles. It said sales grew at its established stores last quarter by the strongest degree in nearly a decade.

- Walmart and Home Depot also reported better results than analysts expected. Walmart benefited from surging sales for its online business, as customers looked to buy necessities without having to go to a store. Home Depot, meanwhile, saw more people picking up do-it-yourself projects as the pandemic kept many working from home. Their stocks, though, were more muted. Walmart was down 1.5% after waffling between small gains and losses. Home Depot slipped 1.1%. Home Depot’s report coincided with data from the Commerce Department showing a recovery is continuing for home construction. Builders broke ground on more new homes in July than economists expected, and at a faster pace than June.

- It echoes other data that have shown budding improvements across the economy since the spring, as widespread shutdowns have eased. The worry, though, is that conditions could backtrack if coronavirus counts worsen or if Washington can’t broker a deal on more aid for an economy that investors say absolutely needs it. Extra unemployment benefits for workers and other stimulus for the economy have already expired.

- Numerous other risks are also hanging over the market. The world’s two largest economies keep ratcheting up their tensions, and China on Tuesday accused Washington of damaging global trade with sanctions that threaten to cripple tech giant Huawei. China added that it will protect Chinese companies, though it gave no indication of possible retaliation.

- The yield on the 10-year Treasury dipped to 0.66% from 0.69% late Monday.

- In Asia, South Korea’s Kospi led regional losses, slumping 2.5% amid worries over surging coronavirus cases. Hong Kong’s Hang Seng index lost 0.2%, Japan’s Nikkei 225 slipped 0.2% and stocks in Shanghai added 0.4%.

- In Europe, Germany’s DAX slipped 0.4%. The French CAC 40 lost 0.7%, and the FTSE 100 in London dipped 0.8%.

- Benchmark U.S. crude oil fell 0.7% to $42.25 per barrel. Brent crude, the international standard, slipped 0.4% to $45.18 per barrel.

- Gold added 0.4% to $2,005.70 per ounce.

- Stocks are drifting on Wall Street Tuesday, and the S&P 500 is once again bouncing against its record closing level, which has been acting as its ceiling in recent days. The S&P 500 was virtually flat at 3,382.24 in midday trading. Earlier, it briefly rose above its record closing high of 3,386.15, which was set in February before the pandemic pancaked the economy. It’s the fourth time in the last week that’s happened, and each past time, the index faded back below that record level during the afternoon.

- This is the first day, though, that the S&P 500 crested above 3,393.52, which had stood since Feb. 19 as the highest level it ever touched within a day’s trading. The Dow Jones Industrial Average was down 87 points, or 0.3%, at 27,757, as of 11:12 a.m. Eastern time, and the Nasdaq composite was up 0.4%. Trading has been very quiet in recent days, after a tremendous rally since March wiped out virtually all of the nearly 34% drop the S&P 500 suffered earlier from its all-time high. Tremendous amounts of aid from the Federal Reserve and Congress helped launch the rally, which built higher on signs of budding growth in the economy. More recently, corporate profit reports that weren’t as bad as expected have helped boost stock prices.

- Now, analysts say markets are taking a pause with less news flowing in amid a seasonally slow period of trading. Big U.S. companies are mostly finished reporting their earnings for the spring, while investors are waiting to see if Congress and the White House can get past their partisan differences and agree on more aid for the economy.

- It’s mostly just retailers left in the S&P 500 to report their second-quarter results, and several continued the strong recent trend of delivering better results than expected.

- Advance Auto Parts rose 1.2% after it reported a much bigger jump in earnings for the spring than analysts had forecast. It said enhanced unemployment benefits and other aid for the economy provided earlier by the U.S. government helped its customers afford parts to repair and service their automobiles. It said sales grew at its established stores last quarter by the strongest degree in nearly a decade.

- Walmart and Home Depot also reported better results than analysts expected. Walmart benefited from surging sales for its online business, as customers looked to buy necessities without having to go to a store. Home Depot, meanwhile, saw more people picking up do-it-yourself projects as the pandemic kept many working from home. Their stocks, though, were more muted. Walmart was down 1.5% after waffling between small gains and losses. Home Depot slipped 1.1%. Home Depot’s report coincided with data from the Commerce Department showing a recovery is continuing for home construction. Builders broke ground on more new homes in July than economists expected, and at a faster pace than June.

- It echoes other data that have shown budding improvements across the economy since the spring, as widespread shutdowns have eased. The worry, though, is that conditions could backtrack if coronavirus counts worsen or if Washington can’t broker a deal on more aid for an economy that investors say absolutely needs it. Extra unemployment benefits for workers and other stimulus for the economy have already expired.

- Numerous other risks are also hanging over the market. The world’s two largest economies keep ratcheting up their tensions, and China on Tuesday accused Washington of damaging global trade with sanctions that threaten to cripple tech giant Huawei. China added that it will protect Chinese companies, though it gave no indication of possible retaliation.

- The yield on the 10-year Treasury dipped to 0.66% from 0.69% late Monday.

- In Asia, South Korea’s Kospi led regional losses, slumping 2.5% amid worries over surging coronavirus cases. Hong Kong’s Hang Seng index lost 0.2%, Japan’s Nikkei 225 slipped 0.2% and stocks in Shanghai added 0.4%.

- In Europe, Germany’s DAX slipped 0.4%. The French CAC 40 lost 0.7%, and the FTSE 100 in London dipped 0.8%.

- Benchmark U.S. crude oil fell 0.7% to $42.25 per barrel. Brent crude, the international standard, slipped 0.4% to $45.18 per barrel.

- Gold added 0.4% to $2,005.70 per ounce.

Our Technical Analyst’s Commentary

SPX Daily Chart

- The S&P 500 moved up by 0.27% to end the day at 3382. The total intraday range was 8.4 points.

- The intraday range has shrunk in the past few days, which suggests that both the bulls and the bears are playing it safe.

- However, with bulls holding on to their positions, the possibility of an upside breakout8 is high.

- Following the tight range action of the past few days, the breakout8 is likely to be strong.

- As we have been saying, if the index sustains the new highs for three days, we anticipate a melt up because a new high is likely to attract further buying from traders who have missed buying at lower levels.

- However, if the bulls fail to sustain the new highs, then a few days of consolidation11 or minor correction12 is possible.

- We remain cautious and will start turning bearish3 if the index breaks6 and sustains below the 20-day EMA.

Market Data

- 1529 stocks advanced on the NYSE, whereas, 1452 stocks declined. 91 stocks made new 52-week highs, whereas, 11 stock made new 52-week lows.

- 1842 stocks advanced on the Nasdaq, whereas, 1549 stocks declined. 135 stock made new 52-week highs, whereas, 14 stock made new 52-week lows.

Intraday Chart

- The index opened strong but the bulls could not build up on the initial strength, which shows profit taking close to 3388 levels.

- On the downside, the bulls purchased the dips to 3379 levels, hence, most of the day was spent in a tight range.

- Today, a break6 above 3388 can propel the index to 3400 and then to 3416.

- On the other hand, a break6 below 3378 can sink the index to 3364.

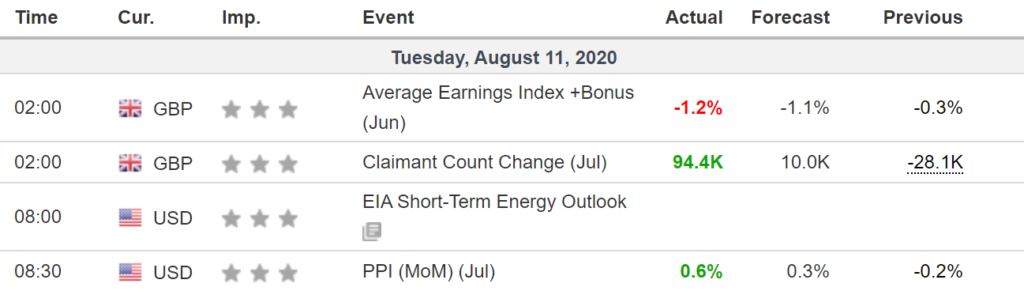

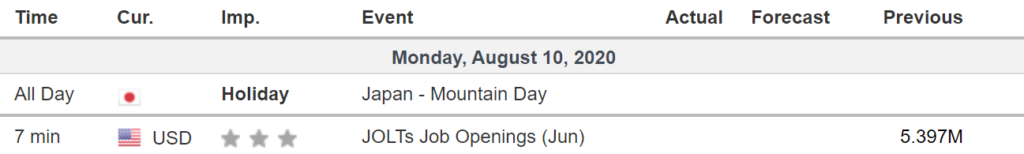

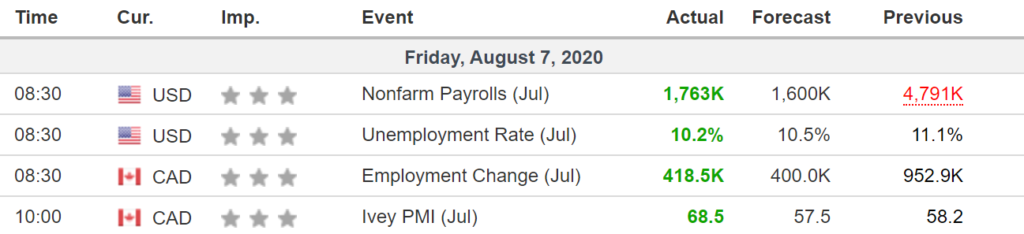

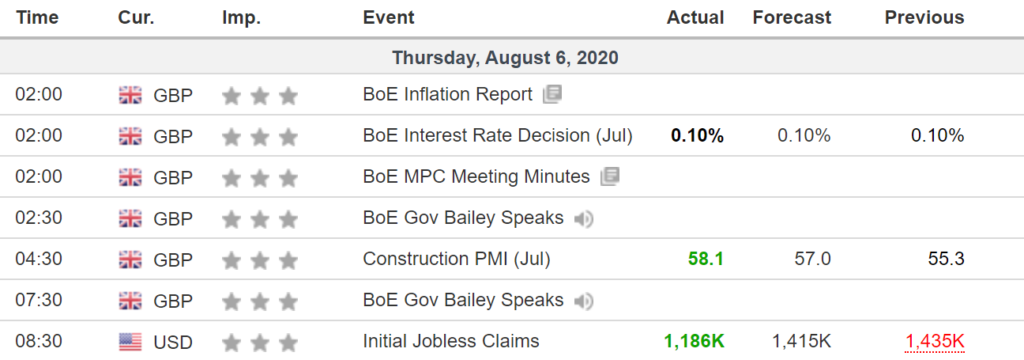

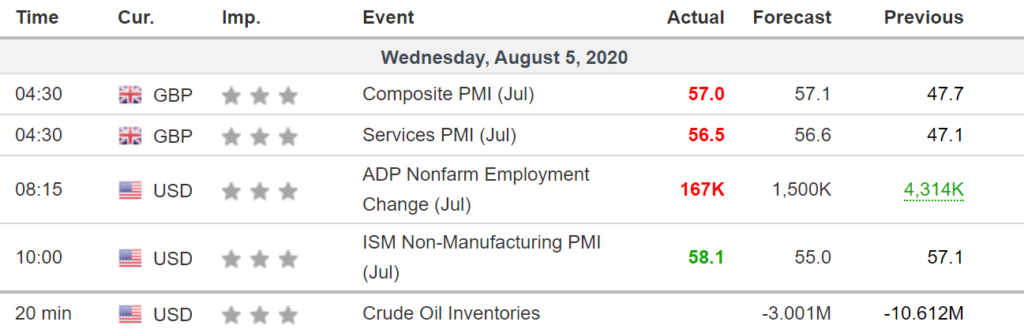

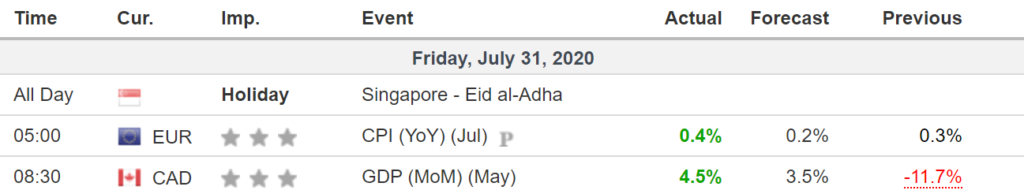

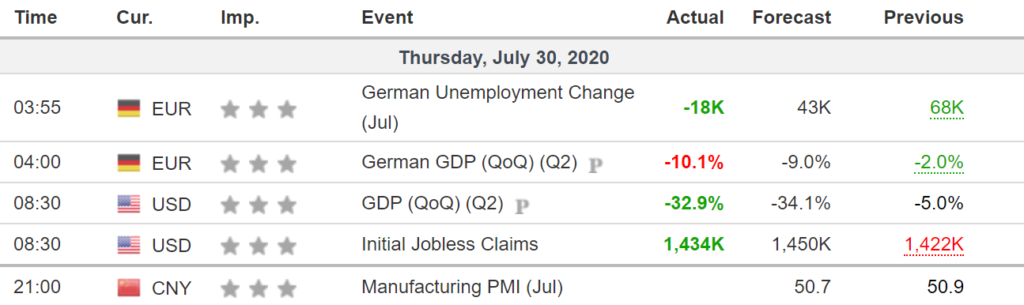

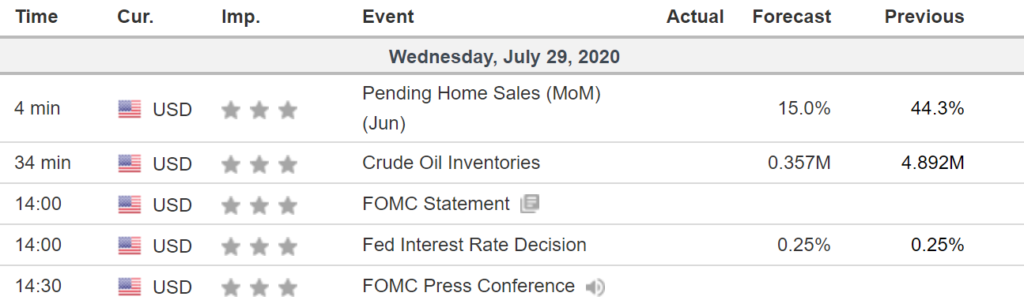

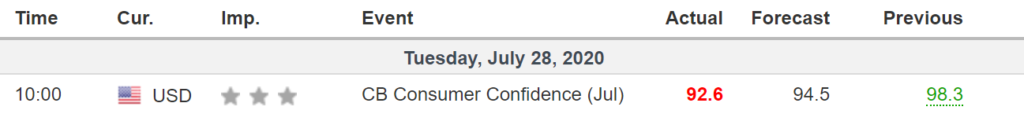

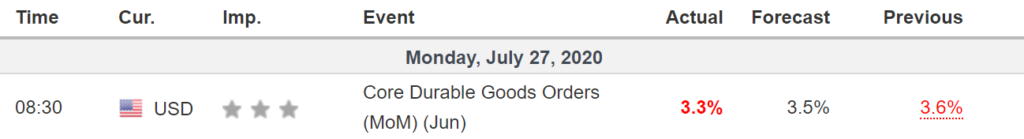

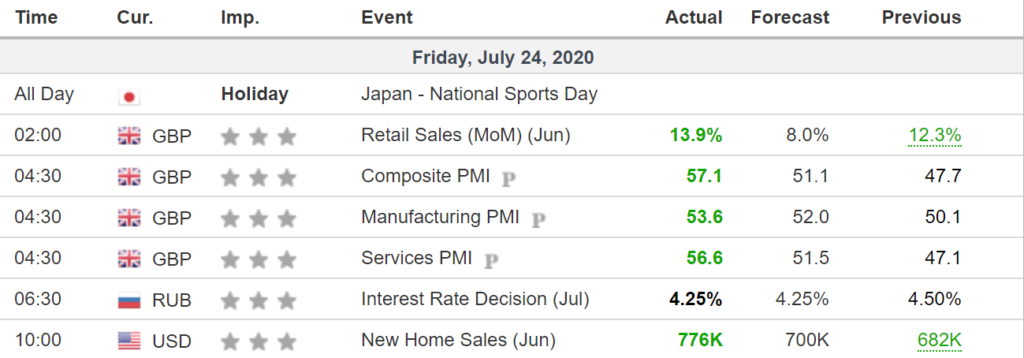

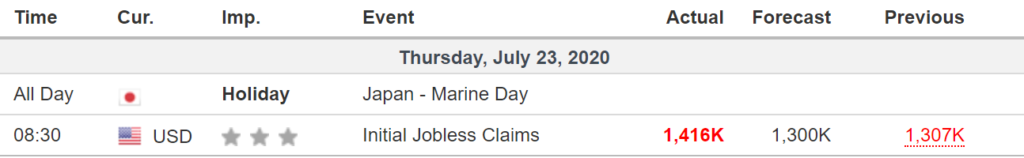

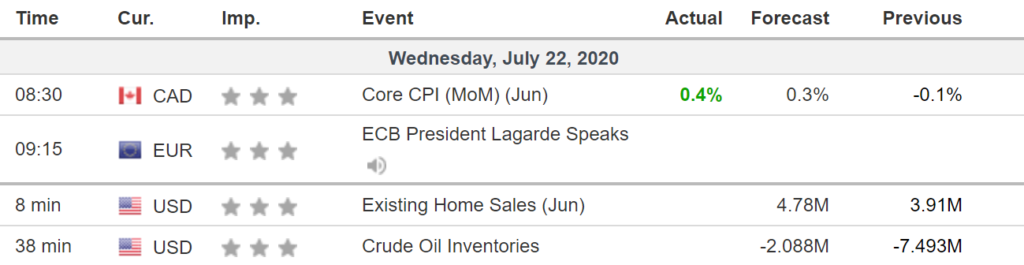

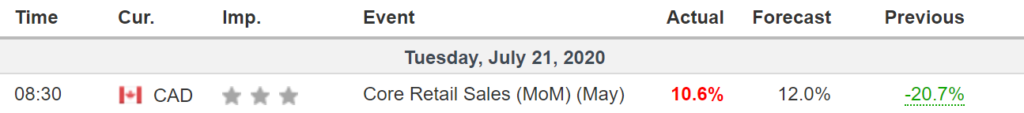

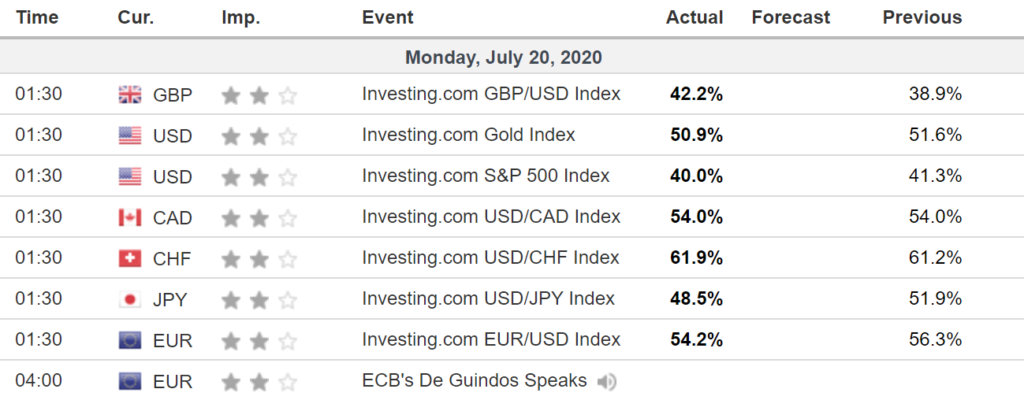

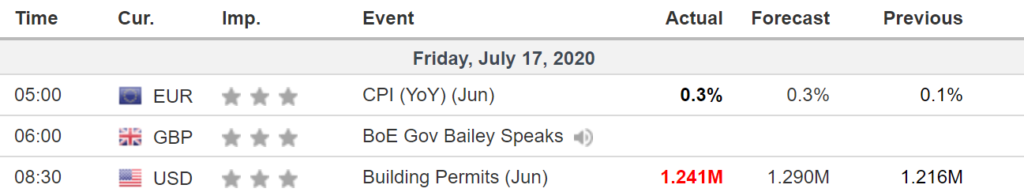

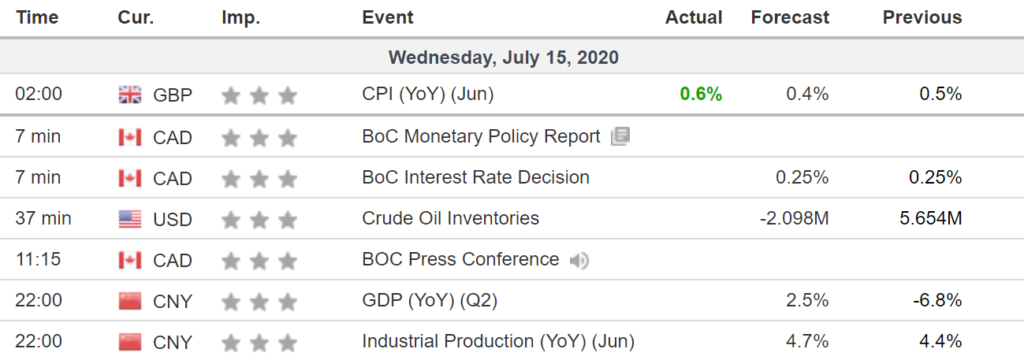

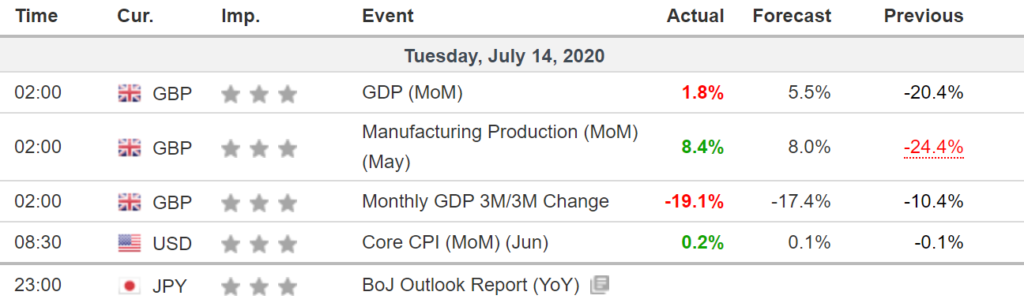

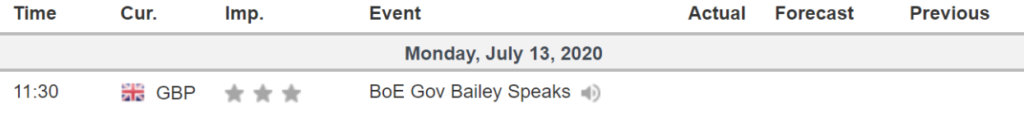

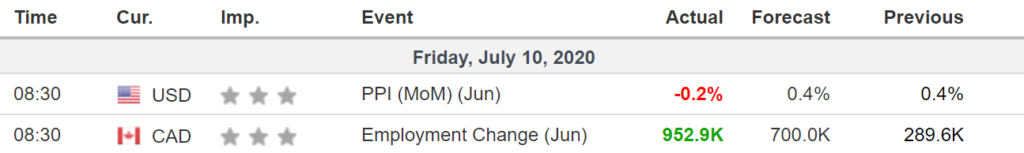

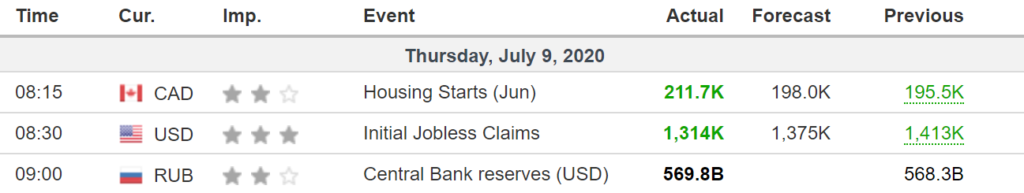

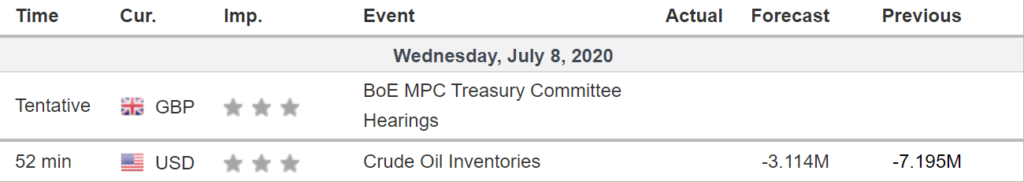

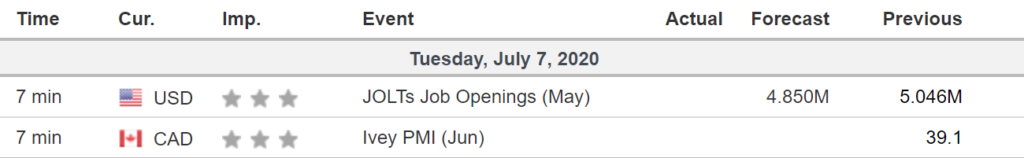

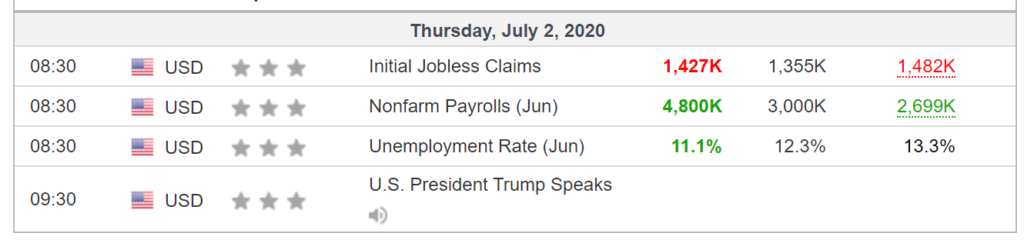

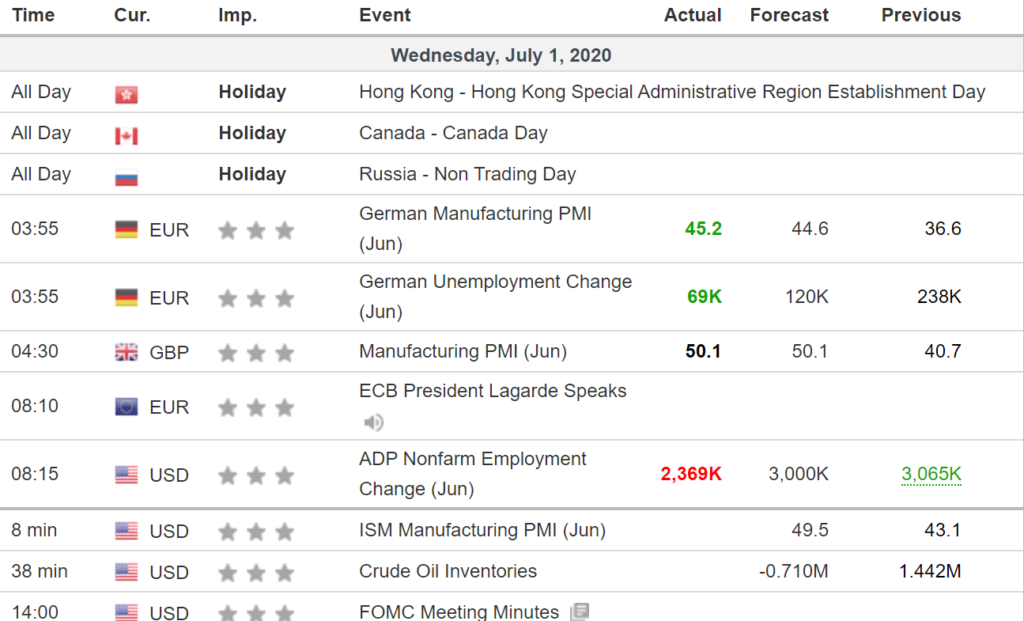

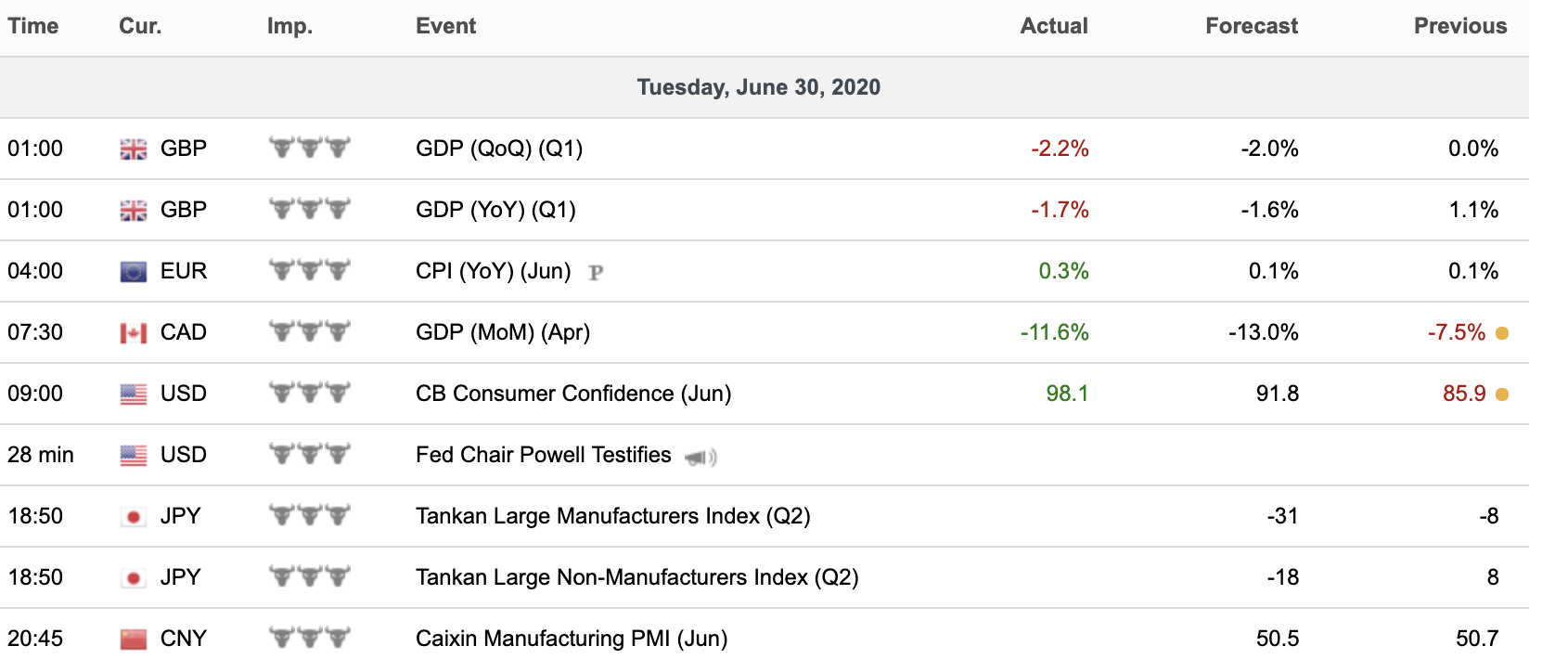

Economic Calendar Release

Glossary

- Ascending Channel – An ascending channel is the price action contained between upward sloping parallel lines. Higher pivot highs and higher pivot lows are technical signals of an uptrend. Trendlines frame out the price channel by drawing the lower line on pivot lows, and the upper line is the channel line drawn on pivot highs. Price is not always perfectly contained but the channel lines show areas of support and resistance for price targets. A higher high above an ascending channel can signal continuation. A lower low below the low of an ascending channel can signal trend change.

- Ascending triangle pattern – is a bullish formation that usually forms during an uptrend as a continuation pattern.

- Bearish (view) – Investors who believe that a stock price will decline.

- Bearish Engulfing pattern – chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses or “engulfs” the small white one.

- Bottom- the lowest price reached by a financial security, commodity, index or economic cycle in a given time period. A specific time span is usually used to determine a bottom, and that timeframe can be a year, month or even intraday.

- Break – a rapid and sharp price decline.

- Breakdown – price movement through an identified level of support, which is usually followed by heavy volume and sharp declines.

- Breakout- a price movement of a security through an identified level of resistance, which is usually followed by heavy volume and an increased amount of volatility.

- Bullish (view) – Investors who believe that a stock price will increase over time

- Candlestick – a chart that displays the high, low, opening and closing prices of a security for a specific period. The wide part of the candlestick is called the “real body” and tells investors whether the closing price was higher or lower than the opening price.

- Consolidation- is used in technical analysis to describe the movement of a stock’s price within a well-defined pattern of trading levels. Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern

- Correction – a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation; generally temporary price declines interrupting an uptrend in the market or an asset; shorter duration than a bear market or a recession, but it can be a precursor to either.

- Descending Triangle pattern – A bearish chart pattern that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically proven to be a strong level of support.

- Doji – candlesticks that look like a cross, inverted cross or plus sign; forms when a security’s open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts

- Double top – technical analysis to describe the rise of a stock, a drop, another rise to the same level as the original rise, and finally another drop.

- Dry powder – is a term referring to marketable securities that are highly liquid and considered cash-like. Dry powder can also refer to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered to be dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- Evening Star – a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large white candlestick located within an uptrend; the middle bar is a small-bodied candle, red or white, that closes above the first white bar; and, the last bar is a large red candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the uptrend is about to reverse.

- Falling Knife – is a colloquial term for a rapid drop in the price or value of a security

- Gravestone doji – a type of candlestick pattern that is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day.

- Head and Shoulders pattern – a chart formations that predicts a bullish-to-bearish trend reversal; believed to be one of the most reliable trend reversal appears. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end.

- Inside Day formation – A candlestick formation that occurs when the entire daily price range for a given security falls within the price range of the previous day. Inside day often refers to all versions of the harami pattern and can be very useful for spotting changes in the direction of a trend.

- Long legged doji – a type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. This candlestick is often used to signal indecision about the future direction of the underlying asset.

- Pullback – the falling back of a security’s price from its peak. These price movements might be seen as a brief reversal of the prevailing trend higher, signaling a temporary pause in upward momentum. Also referred to as a retracement or consolidation

- Relative Strength Index – (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100. Traditionally RSI is considered overbought when above 70 and oversold when below 30.

- Resistance – a price point on a bar chart for a security in which upward price movement is impeded by an overwhelming level of supply for the security that accumulates at a particular price level.

- Rounding Top pattern – is identified by price movements that, when graphed, form the shape of an upside down “U”; may form at the end of an extended upward trend and indicates a reversal in the long-term price movement; considered a rare occurrence.

- Support Level – refers to the price level below which, historically, a stock has had difficulty falling. It is the level at which buyers tend to enter the stock.

- Wedge – a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape.

*Glossary definitions provided through Investopedia.

Follow us on Facebook and Twitter for timely market information.

08/17/20

08/17/20

Internal Markets Commentary

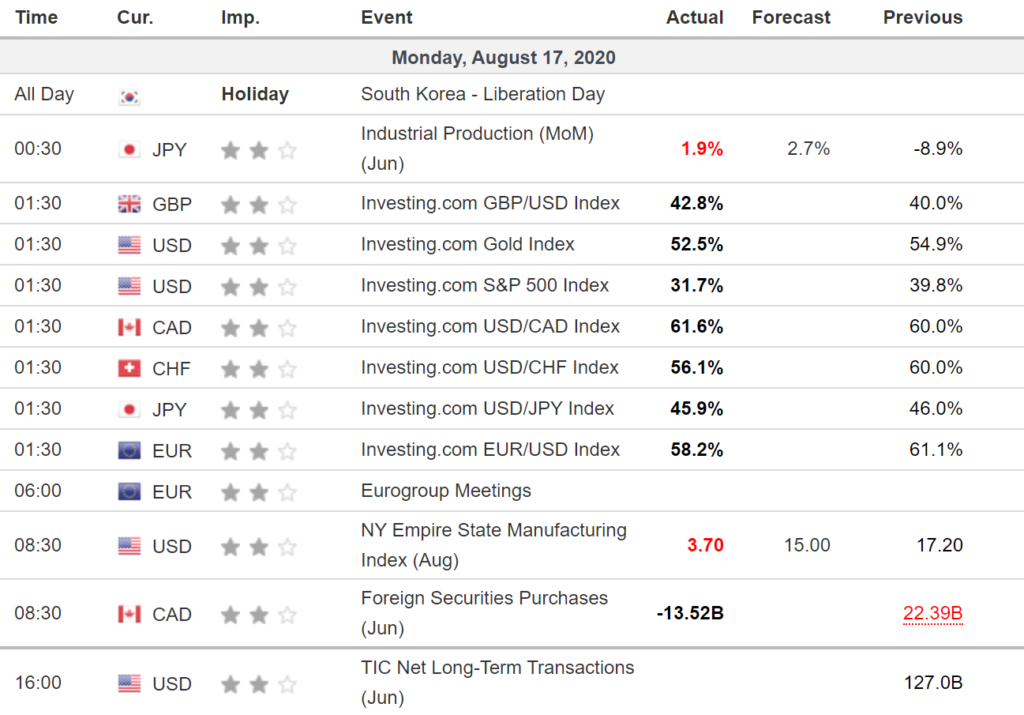

- The S&P 500 Index ($SPX) is up +0.34%, the Dow Jones Industrials Index ($DOWI) is down -0.19%, and the Nasdaq 100 Index ($IUXX) is up +0.96%. U.S. stock indexes today are trading mostly higher on strength in technology stocks and a strong U.S. homebuilder confidence report. Stocks are being undercut by U.S./Chinese trade tensions, a weak Empire manufacturing index, and weakness in bank stocks.

- Technology stocks are being led higher today by rallies in Tesla (+7.4%) and Nvidia (+5.5%). Bank stocks were undercut today after news that Berkshire Hathaway reduced its stakes in some big U.S. banks. Boeing (-3.2%) today fell on U.S./Chinese tensions and its report that it received no new orders in July. Boeing’s decline weighed on the Dow Jones Industrials index. U.S. stocks are being undercut today by U.S./Chinese tensions after Saturday’s U.S./China 6-month review of the phase-one trade deal was indefinitely postponed. That review was expected to be a teleconference on Saturday among U.S. Trade Representative Lighthizer, Treasury Secretary Mnuchin, and Chinese Vice Premier Liu. Scheduling delays were cited as the reason for the postponement, but the markets suspect there is a backstory that involves larger U.S./Chinese tensions. Chinese Foreign Ministry spokesman Zhao Lijian on Monday refused to answer a question about why Saturday’s meeting was postponed.

- U.S. stocks saw some carry-over support from today’s sharp rally by the Shanghai Composite index, which closed the day up +2.34% and is just below July’s 2-1/2 year high. Chinese stocks received a boost after the Chinese central bank today announced a larger-than-expected reserve injection with 700 billion yuan ($100 billion) of new 1-year funding via the bank’s medium-term lending facility.

- Meanwhile, there was a new move today by the Trump administration against China. The Commerce Department today added 38 Huawei affiliates in 21 countries to the U.S. economic blacklist, seeking to more thoroughly eliminate Huawei equipment from global 5G networks and restrict Huawei’s access to chips.

- Stocks are seeing support from today’s +6 point increase to 78 in the NAHB housing market index, which was much stronger than expectations of +2 to 74. The index matched its record 35-year high, which was originally posted in 1998 (data since 1985). However, stocks were undercut by today’s -13.5 point drop in the Aug Empire manufacturing index to 3.7, which was weaker than expectations for a smaller -2.2 point decline to 15.0.

- House Speaker Pelosi on Sunday called House members back to Washington from their August recess to hold a vote on the Post Office. However, there is no indication there will be any new talks on a pandemic bill after the talks collapsed and President Trump on August 8 issued four executive orders. The stimulus talks are not expected to be revived, if at all, until after Congress returns to Washington after Labor Day from its August recess.

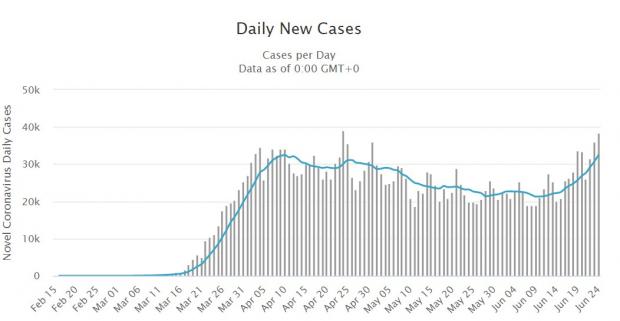

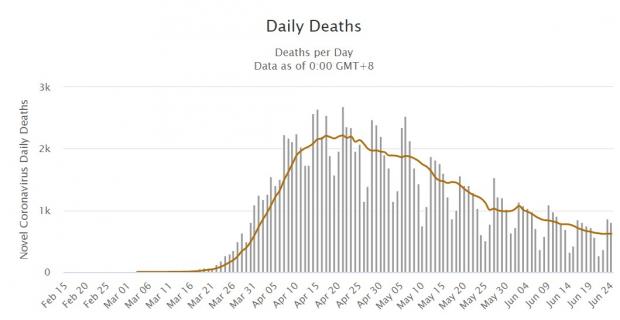

- The ongoing Covid pandemic continues to negatively impact global economic growth and is weighing on stocks. Confirmed cases of Covid have risen above 21.11 million globally, with deaths exceeding 758,000.

- The VIX S&P 500 Volatility Index ($VIX) today is slightly higher by +0.05 at 22.10, consolidating mildly above last Tuesday’s 5-3/4 month low of 20.28. The VIX is far below March’s 11-1/2 year high of 85.47.

Our Technical Analyst’s Commentary

SPX Daily Chart

- The S&P 500 finished the week with another small range day. The index corrected 0.02% to close at 3372.9. The total intraday range was 16.9 points.

- Although the index is struggling to breakout8 to new all-time highs, the bulls are not closing their positions. This increases the possibility of an upside breakout8.

- If the index enters a melt up after breaking out8 to new highs, then it is likely to be a good place to take profits.

- Conversely, if the index turns down from the current levels or reverses direction after making new highs and breaks6 below the 20-day EMA, then it will indicate profit taking and could result in a deeper correction.

- Currently, the sentiment is positive and any dips will be viewed as a buying opportunity.

- The number of stocks at new 52-week highs has been reducing gradually, which shows profit taking by a few traders. Therefore, we remain cautious but have not yet turned negative.

Market Data

- 1492 stocks advanced on the NYSE, whereas, 1449 stocks declined. 44 stocks made new 52-week highs, whereas, 7 stock made new 52-week lows.

- 1553 stocks advanced on the Nasdaq, whereas, 1770 stocks declined. 55 stock made new 52-week highs, whereas, 14 stock made new 52-week lows.

Intraday Chart

- The index again spent most of the day inside the tight range of 3364-3378. Usually, these tight ranges resolve with a sharp move up or down.

- On the downside, the bears broke below 3364 but the bulls aggressively purchased the dip.

- This shows that the trend remains to buy the dips.

- Today, a break6 above 3378-3388 is likely to attract further buying and start the next leg of the uptrend.

- On the other hand, if the index breaks6 below 3364, the bears are likely to intensify selling that can drag the price down to 3328.

Economic Calendar Release

Glossary

- Ascending Channel – An ascending channel is the price action contained between upward sloping parallel lines. Higher pivot highs and higher pivot lows are technical signals of an uptrend. Trendlines frame out the price channel by drawing the lower line on pivot lows, and the upper line is the channel line drawn on pivot highs. Price is not always perfectly contained but the channel lines show areas of support and resistance for price targets. A higher high above an ascending channel can signal continuation. A lower low below the low of an ascending channel can signal trend change.

- Ascending triangle pattern – is a bullish formation that usually forms during an uptrend as a continuation pattern.

- Bearish (view) – Investors who believe that a stock price will decline.

- Bearish Engulfing pattern – chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses or “engulfs” the small white one.

- Bottom- the lowest price reached by a financial security, commodity, index or economic cycle in a given time period. A specific time span is usually used to determine a bottom, and that timeframe can be a year, month or even intraday.

- Break – a rapid and sharp price decline.

- Breakdown – price movement through an identified level of support, which is usually followed by heavy volume and sharp declines.

- Breakout- a price movement of a security through an identified level of resistance, which is usually followed by heavy volume and an increased amount of volatility.

- Bullish (view) – Investors who believe that a stock price will increase over time

- Candlestick – a chart that displays the high, low, opening and closing prices of a security for a specific period. The wide part of the candlestick is called the “real body” and tells investors whether the closing price was higher or lower than the opening price.

- Consolidation- is used in technical analysis to describe the movement of a stock’s price within a well-defined pattern of trading levels. Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern

- Correction – a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation; generally temporary price declines interrupting an uptrend in the market or an asset; shorter duration than a bear market or a recession, but it can be a precursor to either.

- Descending Triangle pattern – A bearish chart pattern that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically proven to be a strong level of support.

- Doji – candlesticks that look like a cross, inverted cross or plus sign; forms when a security’s open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts

- Double top – technical analysis to describe the rise of a stock, a drop, another rise to the same level as the original rise, and finally another drop.

- Dry powder – is a term referring to marketable securities that are highly liquid and considered cash-like. Dry powder can also refer to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered to be dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- Evening Star – a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large white candlestick located within an uptrend; the middle bar is a small-bodied candle, red or white, that closes above the first white bar; and, the last bar is a large red candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the uptrend is about to reverse.

- Falling Knife – is a colloquial term for a rapid drop in the price or value of a security

- Gravestone doji – a type of candlestick pattern that is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day.

- Head and Shoulders pattern – a chart formations that predicts a bullish-to-bearish trend reversal; believed to be one of the most reliable trend reversal appears. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end.

- Inside Day formation – A candlestick formation that occurs when the entire daily price range for a given security falls within the price range of the previous day. Inside day often refers to all versions of the harami pattern and can be very useful for spotting changes in the direction of a trend.

- Long legged doji – a type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. This candlestick is often used to signal indecision about the future direction of the underlying asset.

- Pullback – the falling back of a security’s price from its peak. These price movements might be seen as a brief reversal of the prevailing trend higher, signaling a temporary pause in upward momentum. Also referred to as a retracement or consolidation

- Relative Strength Index – (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100. Traditionally RSI is considered overbought when above 70 and oversold when below 30.

- Resistance – a price point on a bar chart for a security in which upward price movement is impeded by an overwhelming level of supply for the security that accumulates at a particular price level.

- Rounding Top pattern – is identified by price movements that, when graphed, form the shape of an upside down “U”; may form at the end of an extended upward trend and indicates a reversal in the long-term price movement; considered a rare occurrence.

- Support Level – refers to the price level below which, historically, a stock has had difficulty falling. It is the level at which buyers tend to enter the stock.

- Wedge – a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape.

*Glossary definitions provided through Investopedia.

Follow us on Facebook and Twitter for timely market information.

08/14/20

08/14/20

Internal Markets Commentary

- The complete stalemate in fiscal talks won out over better than expected as US labor market data yesterday with the S&P 500 (-0.20%) failed to capitalize on Wednesday’s surge. It was the last couple hours of the US session where sentiment appeared to shift however and it coincided with another bear steepening in rates which saw the 2s10s curve jump another +4.4bps to 55.8bps and the highest since June 9th. In fact, 10y yields have risen +21.4bps in the last 7 trading sessions alone after having gone a few months without doing much at all. At the long-end, 30y yields climbed +5.4bps to 1.429% after the market struggled to absorb the largest 30y auction on record in the first sign of indigestion following a busy run of supply.

- There was no such struggle for Apple tapping the bond market for the second time since May however, including raising both 30y and 40y bonds, and joining other mega cap and cash rich tech companies like Amazon and Google in raising long-dated debt at ultra-low yields. Credit was slightly weaker yesterday nonetheless with US HY finishing 6bps wider and IG 1bp wider. The DOW closed down -0.29% though the NASDAQ (+0.27%) did just manage to hold its head above water.

- This morning the focus has shifted to China’s July activity data which was slightly disappointing with industrial output rising by +4.8% yoy (vs. +5.2 yoy expected) while retail sales printed at -1.1% yoy (vs. +0.1% yoy expected). Fixed asset investment was in line with expectations at -1.6% yoy and the surveyed jobless rate was unchanged at 5.7%. The Shanghai Comp has given up gains to trade -0.16% following that while the Hang Seng was -0.19%. The biggest decline has come for the Kospi (-1.63%) following a tick up in virus cases. There’s better news for the Nikkei (+0.13%) and ASX (+0.56%).

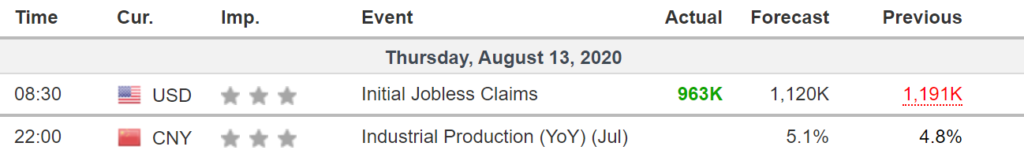

- Data did its best to help risk in the early going with the stronger-than-expected weekly initial jobless claims print in the US, which fell below a million for the first time since the pandemic started. They came in at 963k (vs. 1.1m expected) in the week through August 8, and the report added to hopes that the labor market recovery is continuing into August. This optimism was supported by the continuing claims reading which came in at 15.486m (vs. 15.8m expected), which is its lowest since early April. Nevertheless, to put this progress in some perspective, it’s worth noting that the worst week following the GFC saw initial claims of “only” 665k, so we’re well above that level even now, with a long way to go before we reach pre-Covid normality once again.

- In terms of the latest on the stimulus, it was more of the same with House speaker Nancy Pelosi saying she didn’t know when the next talks with Republicans would take place. Bostic became the latest Fed official to weigh in, saying “I’m hopeful we will see more relief efforts out there to provide that support”. As for the latest on the virus, US cases rose by 53,483 in the past 24 hours (+1.0%) while Florida’s governor warned that more Covid-19 deaths may be coming at nursing homes and assisted-living facilities. Across the other side of Atlantic, Germany recorded the highest number of new cases (1,422) in more than three months, as cases also continue to rise in France (2,669) and Spain (7,550). Meanwhile, the UK imposed a mandatory quarantine requirement for 14 days on travelers from France, the Netherlands and four other countries while at the same time in England theatres, casinos and beauty salons are allowed to reopen. In Asia, South Korea reported a surge in new cases of 103, almost double from a day prior. New Zealand also recorded 12 new confirmed cases in the past 24 hours with 2 being outside of Auckland.

- As for European markets yesterday, sovereign debt lost ground across the continent. 10yr bund yields climbed +3.5bps to reach a one-month high, while 10yr yields on OATs (+4.9bps) and BTPs (+5.0bps) also saw sizeable moves higher.

- Oil prices also came down from their post-pandemic highs, with both WTI (-1.01%) and Brent crude (-1.03%) experiencing declines. The moves came after the International Energy Agency reduced their forecasts for oil demand this year by 140,000 barrels/day, the first downgrade in several months. Their 2021 demand estimate was also revised down by 240,000 barrels/day. Gold continued its recovery with a +1.98% advance, with silver also up +7.81%.

- We got a couple of Brexit headlines yesterday. The first came from the UK’s chief negotiator, David Frost, who tweeted that “Our assessment is that agreement can be reached in September and we will work to achieve this if we can.” The transition period concludes at the end of the year, but with time needed to ratify any agreement, this means that the effective deadline is earlier, and the EU’s chief negotiator, Michel Barnier, has previously pointed to October as the deadline for an agreement. Meanwhile, Prime Minister Johnson met with Irish Prime Minister Martin yesterday, with Martin saying that “It seems to me that there is a landing zone if that will”.

Our Technical Analyst’s Commentary

SPX Daily Chart

- The S&P 500 formed a doji candlestick pattern yesterday. It closed at 3373.4 with a marginal loss of 0.2% for the day. The total intraday range was 23.8 points.

- The positive thing is that the index is closing near the all-time highs. This shows that the bulls are in no hurry to close their positions yet.

- While a new high is almost a certainty, whether the price will sustain the highs is to be seen. That will give us a good idea on what to expect next.

- If the index breaks out to new highs and sustains the levels for a few days, then it is likely to start the next leg of the up move.

- As we have been mentioning, the index will turn negative in the short-term if the bears sink and sustain the price below the 20-day EMA.

- Until then, we shall continue to hold positions but will turn aggressive sellers if the price closes below the 20-day EMA.

Market Data

- 1246 stocks advanced on the NYSE, whereas, 1750 stocks declined. 59 stocks made new 52-week highs, whereas, 3 stock made new 52-week lows.

- 1513 stocks advanced on the Nasdaq, whereas, 1820 stocks declined. 102 stock made new 52-week highs, whereas, 18 stock made new 52-week lows.

- The index largely remained in a range for most of the day, however, the bulls could not scale it above the previous day’s high.

- By the end, the index gave up some ground and closed near the lowest point of the day.

- Today, the bulls will make one more attempt to push the index to all-time highs, while the bears will try to sink the index below 3356 support and start a deeper correction.

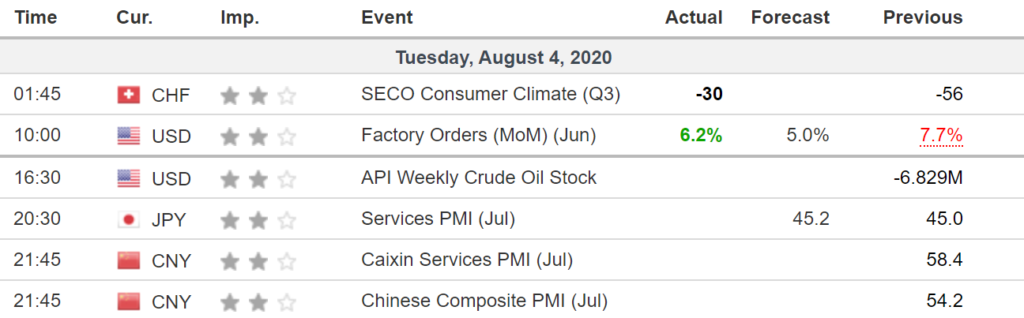

Economic Calendar Release

Glossary

- Ascending Channel – An ascending channel is the price action contained between upward sloping parallel lines. Higher pivot highs and higher pivot lows are technical signals of an uptrend. Trendlines frame out the price channel by drawing the lower line on pivot lows, and the upper line is the channel line drawn on pivot highs. Price is not always perfectly contained but the channel lines show areas of support and resistance for price targets. A higher high above an ascending channel can signal continuation. A lower low below the low of an ascending channel can signal trend change.

- Ascending triangle pattern – is a bullish formation that usually forms during an uptrend as a continuation pattern.

- Bearish (view) – Investors who believe that a stock price will decline.

- Bearish Engulfing pattern – chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses or “engulfs” the small white one.

- Bottom- the lowest price reached by a financial security, commodity, index or economic cycle in a given time period. A specific time span is usually used to determine a bottom, and that timeframe can be a year, month or even intraday.

- Break – a rapid and sharp price decline.

- Breakdown – price movement through an identified level of support, which is usually followed by heavy volume and sharp declines.

- Breakout- a price movement of a security through an identified level of resistance, which is usually followed by heavy volume and an increased amount of volatility.

- Bullish (view) – Investors who believe that a stock price will increase over time

- Candlestick – a chart that displays the high, low, opening and closing prices of a security for a specific period. The wide part of the candlestick is called the “real body” and tells investors whether the closing price was higher or lower than the opening price.

- Consolidation- is used in technical analysis to describe the movement of a stock’s price within a well-defined pattern of trading levels. Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern

- Correction – a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation; generally temporary price declines interrupting an uptrend in the market or an asset; shorter duration than a bear market or a recession, but it can be a precursor to either.

- Descending Triangle pattern – A bearish chart pattern that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically proven to be a strong level of support.

- Doji – candlesticks that look like a cross, inverted cross or plus sign; forms when a security’s open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts

- Double top – technical analysis to describe the rise of a stock, a drop, another rise to the same level as the original rise, and finally another drop.

- Dry powder – is a term referring to marketable securities that are highly liquid and considered cash-like. Dry powder can also refer to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered to be dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- Evening Star – a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large white candlestick located within an uptrend; the middle bar is a small-bodied candle, red or white, that closes above the first white bar; and, the last bar is a large red candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the uptrend is about to reverse.

- Falling Knife – is a colloquial term for a rapid drop in the price or value of a security

- Gravestone doji – a type of candlestick pattern that is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day.

- Head and Shoulders pattern – a chart formations that predicts a bullish-to-bearish trend reversal; believed to be one of the most reliable trend reversal appears. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end.

- Inside Day formation – A candlestick formation that occurs when the entire daily price range for a given security falls within the price range of the previous day. Inside day often refers to all versions of the harami pattern and can be very useful for spotting changes in the direction of a trend.

- Long legged doji – a type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. This candlestick is often used to signal indecision about the future direction of the underlying asset.

- Pullback – the falling back of a security’s price from its peak. These price movements might be seen as a brief reversal of the prevailing trend higher, signaling a temporary pause in upward momentum. Also referred to as a retracement or consolidation

- Relative Strength Index – (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100. Traditionally RSI is considered overbought when above 70 and oversold when below 30.

- Resistance – a price point on a bar chart for a security in which upward price movement is impeded by an overwhelming level of supply for the security that accumulates at a particular price level.

- Rounding Top pattern – is identified by price movements that, when graphed, form the shape of an upside down “U”; may form at the end of an extended upward trend and indicates a reversal in the long-term price movement; considered a rare occurrence.

- Support Level – refers to the price level below which, historically, a stock has had difficulty falling. It is the level at which buyers tend to enter the stock.

- Wedge – a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape.

*Glossary definitions provided through Investopedia.

Follow us on Facebook and Twitter for timely market information.

08/12/20

08/12/20

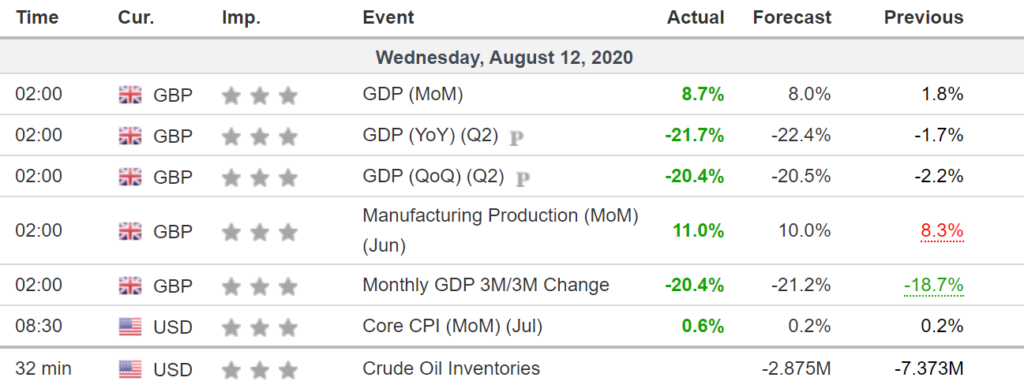

Internal Markets Commentary

- For the most part yesterday looked like it would be another decent day for risk however sentiment turned in the last hour of the US session after Senate majority leader Mitch McConnell told Fox News that the stimulus talks were “at a bit of a stalemate”. Markets have been previously turning a blind eye to the lack of any progress however with the two sides remaining at loggerheads markets may well start to price in more of a risk premium from here. The end result yesterday was the S&P 500 snapping a run of 7 successive advances to close -0.80% lower having reached an intraday high of +0.61% which tested the February all-time highs. More of a consistent theme all day however was the continued sector rotation out of tech which saw the NASDAQ close down -1.69%.

- The other talk point yesterday was the bear steepening in bond markets. Indeed 10yr (+6.6bps) and 30yr (+7.5bps) Treasury yields saw their biggest increases in over a month, while the 2s10s curve steepened +4.6bps, the most since June 5th. The curve has steepened over 10bps since last Tuesday and is now back above 50bps with part of the driver being the deluge of issuance this week including a large 10y auction today and 30y auction tomorrow. It’s worth noting that corporate IG issuance has maintained a decent run rate this month too, at $69bn in August so far – on course to be the busiest August ever – and with a number of record low coupons hit in recent days.

- Yields have continued to tick higher with 10y and 30y Treasuries up another +1.5bps and +2.3bps respectively. Equity markets in Asia have also followed Wall Street’s lead with the Shanghai Comp (-1.99%), Hang Seng (-0.19%), Kospi (-0.09%) and ASX (-0.34%) all lower. Only the Nikkei (+0.35%) bucked the trend. In FX, the New Zealand dollar is down -0.47% after the country’s central bank said it would boost its large-scale asset-purchase program while keeping rates unchanged. The RBNZ also said that it is actively preparing for negative rates. Meanwhile, the US dollar index is up +0.23%, marking 3 days of continuous gains.

- Risk had been supported by President Trump’s comments about a potential capital gains tax cut even though we didn’t see any follow up to that in yesterday’s session. Regardless, while Trump can’t unilaterally cut the current rate without Congress the suggestion was that the President could issue an executive order that would mean no tax is paid on any appreciation tied to inflation. Kudlow’s comment about China “meeting the obligations of the trade deal” also helped solidify the moves and by the end of play in Europe, the STOXX 600 (+1.68%), the DAX (+2.04%) and the CAC 40 (+2.41%) all saw solid gains. The biggest sector winner however was banks which is unsurprising given the rates moves, with US banks rallying +2.43% and European banks rallying +4.06% after 10y bunds rose +5.0bps. That being said the flight to risk did see a tightening in peripheral spreads, as the gap between both Italian (-2.5bps) and Spanish (-2.5bps) 10yr debt over bunds fell to their lowest levels in nearly 6 months.

- Meanwhile, safe havens suffered with the risk-on move. Gold closed down -5.69% in its worst daily performance in over 7 years, and has dipped another -2.06% overnight to trade below $1900. Other asset classes weren’t immune to this pattern, with the traditional haven of the Japanese Yen as the worst performer among the G10 currencies, just as sovereign debt also lost significant ground. As for oil, that also came down from post-pandemic highs, with WTI (-0.79%) and Brent (-1.09%) both losing ground.

- On the coronavirus, the main development yesterday came from Russian President Putin, who said that Russia had become the first country that has granted regulatory approval for a vaccine, and added that his own daughter had received it. That said, other nations sounded a note of skepticism, and US health secretary Alex Azar said that the point was “not to be first with the vaccine, the point is to have a vaccine that is safe and effective”.

- In terms of other virus developments, New Zealand has placed Auckland under lockdown for an initial period of three days to trace the origin of the infections after 4 new cases were detected in a household while social distancing rules and limits on gatherings have been re-imposed on the rest of the country. Meanwhile, more than half of the respondents in a survey in Japan said the government should declare a new state of emergency. Australia’s State of Victoria is also continuing to see high growth in new cases as it reported a further 410 in the past 24 hours and recorded a record 21 deaths in a day. Across the other side of the world, new cases in the US rose by 1.0% in the past 24 hours versus the average 1.1% daily gain over the past week.

- With less than 3 months to go now until the presidential election, we got the news yesterday that Democratic nominee and former Vice President Joe Biden had picked California Senator Kamala Harris as his own vice presidential running mate. Harris herself ran for president in the Democratic primaries, being one of the frontrunners for the nomination last summer, though she ended her campaign before the first primaries took place. Markets have increasingly focused on Biden’s platform in recent weeks given his consistent polling lead, and a new national poll yesterday from Monmouth University showed Biden with a 10-point lead over President Trump, with 51% to 41%. We should hear more from Harris today, who’s expected to speak in Biden’s home state of Delaware.

- As for the data yesterday, in the UK labor market data showed a -220k fall in employment in the three months to June, which is the steepest decline since 2009, even if it was somewhat better than the -300k expected. Though the unemployment rate did unexpectedly remain at 3.9%, other data showed a more worrying picture, with the more up-to-date vacancies reading for the three months through July, which is a good proxy for labor demand, only up to 370k, so still beneath the lows seen after the GFC. Furthermore, early estimates from HMRC payrolls data show that in July, the number of payroll employees was down by -730k compared with March. Separately, other releases included the US PPI reading, which rose by a stronger-than-expected 0.6% month-on-month (vs. 0.3% expected), while the ZEW survey of investor expectations rose to 71.5 in August, its highest since December 2003, even as the current situation reading fell back to -81.3.

Our Technical Analyst’s Commentary

SPX Daily Chart

- The S&P 500 came within a whisker of the all-time highs but could not hold on to the levels. Profit taking dragged the index to 3333.7, a drop of 0.8%. The total intraday range was 54.6 points.

- Yesterday, the index reversed direction from close to the all-time highs, which shows profit taking by some short-term traders.

- The index has formed a bearish engulfing pattern4, which usually acts as a reversal pattern. Today, if the index again corrects sharply, it will increase the possibility of a deeper correction12 to the 50-day SMA at 3183.

- However, the number of stocks at new 52-week highs is still in triple digits, which shows that the strong stocks are holding up well.

- If the index recovers and moves up sharply today, then the bearish3 candlestick10 pattern will be invalidated.

- Therefore, we will watch for the next couple of days and then start taking profits aggressively if the index slips below 20-day EMA.

Market Data

- 1497 stocks advanced on the NYSE, whereas, 1483 stocks declined. 118 stocks made new 52-week highs, whereas, 3 stock made new 52-week lows.

- 1364 stocks advanced on the Nasdaq, whereas, 2013 stocks declined. 116 stock made new 52-week highs, whereas, 10 stock made new 52-week lows.

Intraday Chart

- The index broke above the 3378.8 resistance25 but the bulls could not hold on to the higher levels. This attracted profit taking and the selling intensified as the markets broke below the previous day’s low of 3361.6.

- Today, the bears will try to resume the down move. The next support on the downside is at 3320 and then 3290.

- On the other hand, the bulls will try to stage a recovery, which is likely to gain strength above 3360.

Economic Calendar Release

Glossary

- Ascending Channel – An ascending channel is the price action contained between upward sloping parallel lines. Higher pivot highs and higher pivot lows are technical signals of an uptrend. Trendlines frame out the price channel by drawing the lower line on pivot lows, and the upper line is the channel line drawn on pivot highs. Price is not always perfectly contained but the channel lines show areas of support and resistance for price targets. A higher high above an ascending channel can signal continuation. A lower low below the low of an ascending channel can signal trend change.

- Ascending triangle pattern – is a bullish formation that usually forms during an uptrend as a continuation pattern.

- Bearish (view) – Investors who believe that a stock price will decline.

- Bearish Engulfing pattern – chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses or “engulfs” the small white one.

- Bottom- the lowest price reached by a financial security, commodity, index or economic cycle in a given time period. A specific time span is usually used to determine a bottom, and that timeframe can be a year, month or even intraday.

- Break – a rapid and sharp price decline.

- Breakdown – price movement through an identified level of support, which is usually followed by heavy volume and sharp declines.

- Breakout- a price movement of a security through an identified level of resistance, which is usually followed by heavy volume and an increased amount of volatility.

- Bullish (view) – Investors who believe that a stock price will increase over time

- Candlestick – a chart that displays the high, low, opening and closing prices of a security for a specific period. The wide part of the candlestick is called the “real body” and tells investors whether the closing price was higher or lower than the opening price.

- Consolidation- is used in technical analysis to describe the movement of a stock’s price within a well-defined pattern of trading levels. Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern

- Correction – a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation; generally temporary price declines interrupting an uptrend in the market or an asset; shorter duration than a bear market or a recession, but it can be a precursor to either.

- Descending Triangle pattern – A bearish chart pattern that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically proven to be a strong level of support.

- Doji – candlesticks that look like a cross, inverted cross or plus sign; forms when a security’s open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts

- Double top – technical analysis to describe the rise of a stock, a drop, another rise to the same level as the original rise, and finally another drop.

- Dry powder – is a term referring to marketable securities that are highly liquid and considered cash-like. Dry powder can also refer to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered to be dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- Evening Star – a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large white candlestick located within an uptrend; the middle bar is a small-bodied candle, red or white, that closes above the first white bar; and, the last bar is a large red candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the uptrend is about to reverse.

- Falling Knife – is a colloquial term for a rapid drop in the price or value of a security

- Gravestone doji – a type of candlestick pattern that is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day.

- Head and Shoulders pattern – a chart formations that predicts a bullish-to-bearish trend reversal; believed to be one of the most reliable trend reversal appears. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end.

- Inside Day formation – A candlestick formation that occurs when the entire daily price range for a given security falls within the price range of the previous day. Inside day often refers to all versions of the harami pattern and can be very useful for spotting changes in the direction of a trend.

- Long legged doji – a type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. This candlestick is often used to signal indecision about the future direction of the underlying asset.

- Pullback – the falling back of a security’s price from its peak. These price movements might be seen as a brief reversal of the prevailing trend higher, signaling a temporary pause in upward momentum. Also referred to as a retracement or consolidation

- Relative Strength Index – (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100. Traditionally RSI is considered overbought when above 70 and oversold when below 30.

- Resistance – a price point on a bar chart for a security in which upward price movement is impeded by an overwhelming level of supply for the security that accumulates at a particular price level.

- Rounding Top pattern – is identified by price movements that, when graphed, form the shape of an upside down “U”; may form at the end of an extended upward trend and indicates a reversal in the long-term price movement; considered a rare occurrence.

- Support Level – refers to the price level below which, historically, a stock has had difficulty falling. It is the level at which buyers tend to enter the stock.

- Wedge – a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape.

*Glossary definitions provided through Investopedia.

Follow us on Facebook and Twitter for timely market information.

08/11/20

08/11/20

Internal Markets Commentary

- The S&P 500 surpassed the all-time highs from February on a total return basis. This is a fairly astonishing feat when we consider that in late-March the index was down as much as -33.79% from those highs. In price terms it finished +0.27% yesterday which means it’s just -0.76% lower than its all-time closing high. That move also marked the S&P’s 7th consecutive advance for the first time since April 2019.

- While the S&P nudged higher, the Dow Jones saw a much larger +1.30% gain, which is somewhat unusual given the strong correlation between the two indices. Indeed, it’s only the 6th time in the last decade that the Dow’s daily move has been more than one percentage point different to the S&P’s (even if 5 of them have been since the pandemic hit). At the other end of the spectrum though, the NASDAQ (-0.39%) slipped for a rare second consecutive session. At the margin the macro news acted as a bit of headwind and included the news of further Chinese sanctions on US officials after similar measures were announced by the US on Friday, with those sanctioned by China including the Republican senators Marco Rubio, Ted Cruz and Tom Cotton. Chinese Foreign Ministry spokesman Zhao Lijan said yesterday that “China has decided to impose sanctions on those individuals who behaved badly on Hong Kong-related issues”. And in a further sign that US-China tensions are showing no sign of abating any time soon, US Secretary of State Mike Pompeo tweeted yesterday that the arrest of Jimmy Lai under Hong Kong’s national security law was “further proof that the CCP has eviscerated Hong Kong’s freedoms and eroded the rights of its people.”

- Meanwhile, markets continue to turn a bit of a blind eye to the lack of any progress on the next US fiscal package with no updates to report of yesterday. Nevertheless, there was some more positive coronavirus news from the US, with the number of hospitalizations in New York State at the lowest since the start of the pandemic, and the number of cases in Florida at their lowest in over 6 weeks. California and Texas also reported a fall in hospitalizations. Overall, cases in the US grew by 44,647 in last 24 hours or +0.9% while at the same point last week cases had grown by 46,918 or 1.0%. Globally, the number of cases have crossed the 20 million mark. It is worth highlighting that it took 6 months for cases to reach 10 million after the first infection surfaced in China while the second 10 million took only 6 weeks. On the positive side, China has said that it will resume issuing tourist visas for visitors to Macau which has helped casino stocks rally in the region.

- In Asia, the Hang Seng (+2.40%) has led the way up after underperforming on Monday, while the Nikkei (+1.81%) was up following Monday’s holiday. The Kospi (+1.60%) and ASX (+0.84%) all also up. It’s been fairly quiet for overnight news, however President Trump did say that he’s “very seriously” considering a capital gains tax cut “which would create a lot more jobs”.

- In Europe the moves were pretty similar to the US in terms of the upward direction for equities, though the STOXX 600 (+0.30%) still remains nearly 16% beneath its own record high in February, with European indices having underperformed their US counterparts since the pandemic hit. Energy stocks led the rally on both sides of the Atlantic thanks to a strong performance in oil prices, and both WTI (+1.75%) and Brent (+1.33%) saw solid gains. Silver was up +2.93% at a 7-year high of $29.13/oz yesterday, though gold (-0.40%) continued to come down from Thursday’s record high with a 2nd successive decline. Looking at other markets, sovereign bonds advanced modestly in Europe, with yields on 10yr bunds (-1.7bps), OATs (-2.3bps) and BTPs (-0.8bps) all moving lower. Yields on 10yr BTPs were down to 0.918%, their lowest level in nearly 6 months. US Treasuries gave up their gains however, with 10yr yields ending the session up +1.2bps at 0.577%. The MOVE index of implied Treasury volatility did nudge up yesterday however still remains just 2 points off the all-time lows from the end of July. Speaking of volatility, the VIX is now down to 22.13, the lowest since 21 February.

Our Technical Analyst’s Commentary

SPX Daily Chart

- The S&P 500 moved up marginally by 0.27% to end the day at 3360.5. The total intraday range was 27.9 points.

- The index has continued its journey northwards as it notched one more day of gains. This shows that the bulls continue to buy at every higher level.

- Having come this close to the all-time highs, the bulls will try to scale it. If the index sustains above 3400 for three days, the momentum is likely to pick up.

- The index could enter a period of melt up after the index sustains above 3400, which could result in a short-term top for the market.

- Therefore, we are cautious at these levels and will start taking profits aggressively if the index dips below the ascending channel1.

- We are not looking to add fresh positions at the current levels unless the index breaks6 out and sustains the new highs.

- The next few days are critical for the markets as they will give an idea whether the top is in place or not.

Market Data

- 2172 stocks advanced on the NYSE, whereas, 827 stocks declined. 123 stocks made new 52-week highs, whereas, 5 stock made new 52-week lows.

- 2045 stocks advanced on the Nasdaq, whereas, 1313 stocks declined. 133 stock made new 52-week highs, whereas, 8 stock made new 52-week lows.

Intraday Chart

- The index opened strong but the bulls could not build up on the initial strength, which shows profit taking by a few traders.

- However, the bulls stepped in at lower levels, which shows that the buyers are keen to use the intraday dips to enter positions.

- Today, a retest of the new highs is possible. Strong support on the downside is in the 3320-3340 zone.

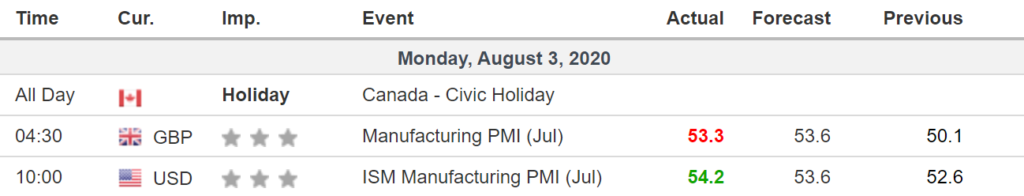

Economic Calendar Release

Glossary

- Ascending Channel – An ascending channel is the price action contained between upward sloping parallel lines. Higher pivot highs and higher pivot lows are technical signals of an uptrend. Trendlines frame out the price channel by drawing the lower line on pivot lows, and the upper line is the channel line drawn on pivot highs. Price is not always perfectly contained but the channel lines show areas of support and resistance for price targets. A higher high above an ascending channel can signal continuation. A lower low below the low of an ascending channel can signal trend change.

- Ascending triangle pattern – is a bullish formation that usually forms during an uptrend as a continuation pattern.

- Bearish (view) – Investors who believe that a stock price will decline.

- Bearish Engulfing pattern – chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses or “engulfs” the small white one.

- Bottom- the lowest price reached by a financial security, commodity, index or economic cycle in a given time period. A specific time span is usually used to determine a bottom, and that timeframe can be a year, month or even intraday.

- Break – a rapid and sharp price decline.

- Breakdown – price movement through an identified level of support, which is usually followed by heavy volume and sharp declines.

- Breakout- a price movement of a security through an identified level of resistance, which is usually followed by heavy volume and an increased amount of volatility.

- Bullish (view) – Investors who believe that a stock price will increase over time

- Candlestick – a chart that displays the high, low, opening and closing prices of a security for a specific period. The wide part of the candlestick is called the “real body” and tells investors whether the closing price was higher or lower than the opening price.

- Consolidation- is used in technical analysis to describe the movement of a stock’s price within a well-defined pattern of trading levels. Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern

- Correction – a reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation; generally temporary price declines interrupting an uptrend in the market or an asset; shorter duration than a bear market or a recession, but it can be a precursor to either.

- Descending Triangle pattern – A bearish chart pattern that is created by drawing one trendline that connects a series of lower highs and a second trendline that has historically proven to be a strong level of support.

- Doji – candlesticks that look like a cross, inverted cross or plus sign; forms when a security’s open and close are virtually equal for the given time period and generally signals a reversal pattern for technical analysts

- Double top – technical analysis to describe the rise of a stock, a drop, another rise to the same level as the original rise, and finally another drop.

- Dry powder – is a term referring to marketable securities that are highly liquid and considered cash-like. Dry powder can also refer to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered to be dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- Evening Star – a bearish candlestick pattern consisting of three candles that have demonstrated the following characteristics: the first bar is a large white candlestick located within an uptrend; the middle bar is a small-bodied candle, red or white, that closes above the first white bar; and, the last bar is a large red candle that opens below the middle candle and closes near the center of the first bar’s body. This pattern is used by traders as an early indication the uptrend is about to reverse.

- Falling Knife – is a colloquial term for a rapid drop in the price or value of a security

- Gravestone doji – a type of candlestick pattern that is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day.

- Head and Shoulders pattern – a chart formations that predicts a bullish-to-bearish trend reversal; believed to be one of the most reliable trend reversal appears. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end.

- Inside Day formation – A candlestick formation that occurs when the entire daily price range for a given security falls within the price range of the previous day. Inside day often refers to all versions of the harami pattern and can be very useful for spotting changes in the direction of a trend.

- Long legged doji – a type of candlestick formation where the opening and closing prices are nearly equal despite a lot of price movement throughout the trading day. This candlestick is often used to signal indecision about the future direction of the underlying asset.

- Pullback – the falling back of a security’s price from its peak. These price movements might be seen as a brief reversal of the prevailing trend higher, signaling a temporary pause in upward momentum. Also referred to as a retracement or consolidation

- Relative Strength Index – (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100. Traditionally RSI is considered overbought when above 70 and oversold when below 30.

- Resistance – a price point on a bar chart for a security in which upward price movement is impeded by an overwhelming level of supply for the security that accumulates at a particular price level.

- Rounding Top pattern – is identified by price movements that, when graphed, form the shape of an upside down “U”; may form at the end of an extended upward trend and indicates a reversal in the long-term price movement; considered a rare occurrence.

- Support Level – refers to the price level below which, historically, a stock has had difficulty falling. It is the level at which buyers tend to enter the stock.

- Wedge – a security price pattern where trend lines drawn above and below a price chart converge into an arrow shape.

*Glossary definitions provided through Investopedia.

Follow us on Facebook and Twitter for timely market information.

08/10/20

08/10/20

Internal Markets Commentary

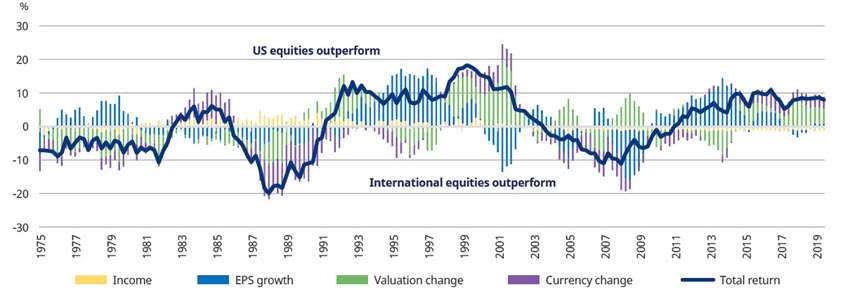

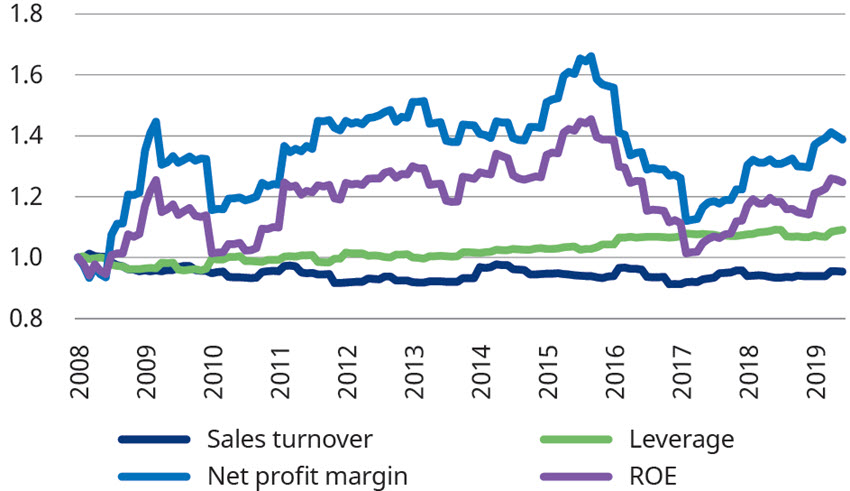

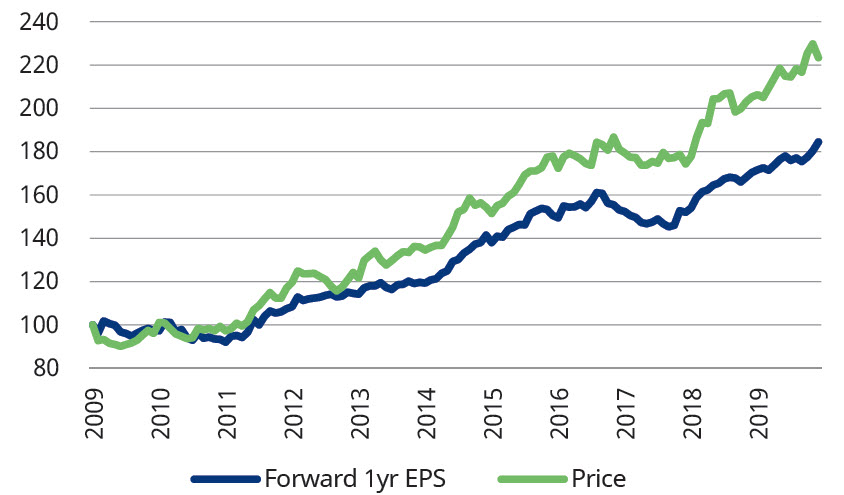

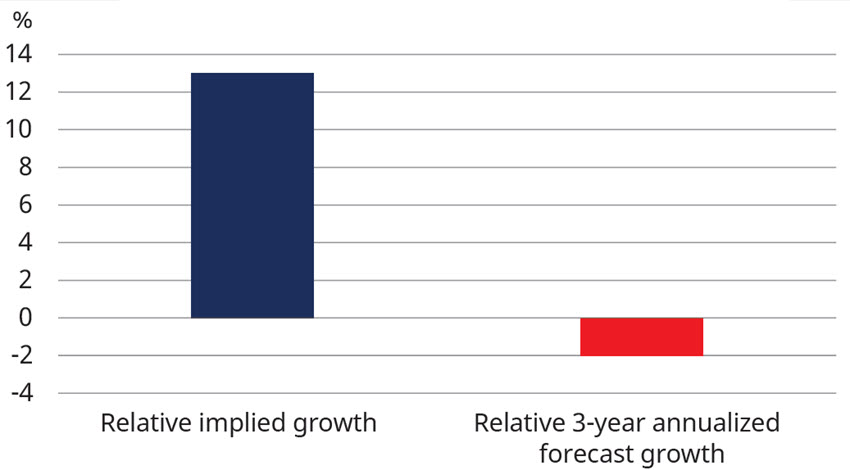

- The U.S. dollar (USD) has been on a wild ride since the beginning of the year. As Covid-19 spread globally and markets came under pressure, the dollar began appreciating sharply, and was up 6.7% year-to-date at its peak on March 20. This was primarily driven by an increase in investor demand for U.S. dollars given the currency’s historical “safe haven” status. Since then, however, the dollar has fallen -9.2%, driven by a confluence of factors including high valuations, falling nominal and real U.S. interest rates, a substantial trade deficit and surging fiscal deficit, a unified fiscal package out of Europe, and slowing COVID-19 case growth outside of the U.S. which has led to better international economic data. However, the question for investors is whether this weakness will continue. We think that the dollar should depreciate over the long run, as the Federal Reserve looks set to keep rates near zero and both the trade and fiscal deficits are likely to remain wide. As a result, investors may want to consider adding international equities to their portfolios, particularly emerging markets, as dollar weakness tends to coincide with rising commodity prices, a pick up in global growth and emerging market outperformance relative to developed market peers.

- The US president has no time for China’s late-night cat gifs: he issued new orders last Friday banning US companies from doing business with WeChat and TikTok. The orders – which come into effect 45 days from now – are the latest attempt by the US to curb China’s power in global technology. America, after all, has a long and growing list of blacklisted Chinese companies that mainly operate in the tech industry. Now it seems TikTok-owner ByteDance and WeChat-owner Tencent are next. As if things weren’t already bad enough for TikTok: the video-sharing network has been in the spotlight since the US threatened to ban its American operations earlier this month. And to make matters worse, Instagram recently launched its own video feed – which might remind TikTok of the time the photo-sharing app knocked Snapchat off the top spot.

- U.S. stock indexes are mixed with the Dow Jones Industrials at 5-1/2 month high. Stocks found support after President Trump on Saturday took executive actions to extend economic aid. Stocks also rallied on better-than-expected U.S. labor market data. Weakness in technology stocks weighed on the Nasdaq 100 and took the S&P 500 from modest gains to modest losses.

- President Trump signed four executive orders, including extending unemployment benefits, eviction protection, student loan relief, and a temporary payroll tax deferral, as Congress remains at an impasse on passing a new virus relief package.

- Today’s U.S. economic data was bullish for stocks after U.S. June JOLTS job openings unexpectedly rose +518,000 to 5.889 million, showing a stronger labor market than expectations for a decline to 5.300 million. Strength in energy stocks today is also supportive of the overall market, with crude oil prices up over +1% on demand optimism.

- European economic data today was bullish for stocks after the Eurozone Aug Sentix investor confidence index rose +4.8 to a 6-month high of -13.4, stronger than expectations of +2.2 to -16.0. Also, the Bank of France July business sentiment indicator rose 10 to a 14-month high of 99, stronger than expectations of +3 to 92.

- On the negative side for stocks is the escalation of U.S./China tensions. China’s Foreign Ministry today said that it would sanction 11 U.S. officials “who behaved badly on Hong Kong-related issues” in a tit-for-tat response to Friday’s action by the U.S. to impose sanctions on 11 Chinese officials over their roles in curtailing political freedoms in Hong Kong.

- Stocks continue to be undercut by the second Covid wave that is sweeping the U.S. and other areas of the world. Confirmed cases of Covid have risen above 20.046 million globally, with deaths exceeding 734,000.

Our Technical Analyst’s Commentary

SPX Daily Chart

- The S&P 500 remained flat on Friday as it moved up 0.06% to end the day at 3351.3. The total intraday range was 23.8 points.

- As long as the index remains inside the ascending channel1, the possibility of a retest of the all-time highs is possible.

- There is nothing negative on the chart. Both moving averages are sloping up and the RSI24 is close to the overbought zone, suggesting that bulls are in command.

- If the bulls can push and sustain the index above 3393.50, the momentum is likely to pick up and we might enter a melt up that might be the last leg of the up move before a sharp fall once again.

- Conversely, if the index turns down and breaks6 below the channel, a drop to the 50-day SMA is possible.

- This is an important support to watch out for. A break6 below this support will indicate a weakening momentum.

- We are holding on to the positions but will start closing them aggressively when the index slips below the channel.

Market Data

- 1891 stocks advanced on the NYSE, whereas, 1078 stocks declined. 98 stocks made new 52-week highs, whereas, 8 stock made new 52-week lows.

- 1460 stocks advanced on the Nasdaq, whereas, 1497 stocks declined. 113 stock made new 52-week highs, whereas, 6 stock made new 52-week lows.

Intraday Chart

- The index opened with mild weakness, which was purchased by the bulls. They tried to push the index above 3351 but the bears defended this level aggressively.

- In the second half of the day, the bears again attempted to sink the index but could not as the bulls stepped in closer to 3330.

- That resulted in a sharp recovery once again, which helped the index close near the highs of the day.

- Today, the index will resume its up move above 3352. On the downside the support is at 3328 and then again at 3320.

Economic Calendar Release

Glossary

- Ascending Channel – An ascending channel is the price action contained between upward sloping parallel lines. Higher pivot highs and higher pivot lows are technical signals of an uptrend. Trendlines frame out the price channel by drawing the lower line on pivot lows, and the upper line is the channel line drawn on pivot highs. Price is not always perfectly contained but the channel lines show areas of support and resistance for price targets. A higher high above an ascending channel can signal continuation. A lower low below the low of an ascending channel can signal trend change.

- Ascending triangle pattern – is a bullish formation that usually forms during an uptrend as a continuation pattern.

- Bearish (view) – Investors who believe that a stock price will decline.

- Bearish Engulfing pattern – chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses or “engulfs” the small white one.

- Bottom- the lowest price reached by a financial security, commodity, index or economic cycle in a given time period. A specific time span is usually used to determine a bottom, and that timeframe can be a year, month or even intraday.

- Break – a rapid and sharp price decline.

- Breakdown – price movement through an identified level of support, which is usually followed by heavy volume and sharp declines.

- Breakout- a price movement of a security through an identified level of resistance, which is usually followed by heavy volume and an increased amount of volatility.

- Bullish (view) – Investors who believe that a stock price will increase over time

- Candlestick – a chart that displays the high, low, opening and closing prices of a security for a specific period. The wide part of the candlestick is called the “real body” and tells investors whether the closing price was higher or lower than the opening price.